How do I claim Back Stamp Duty?

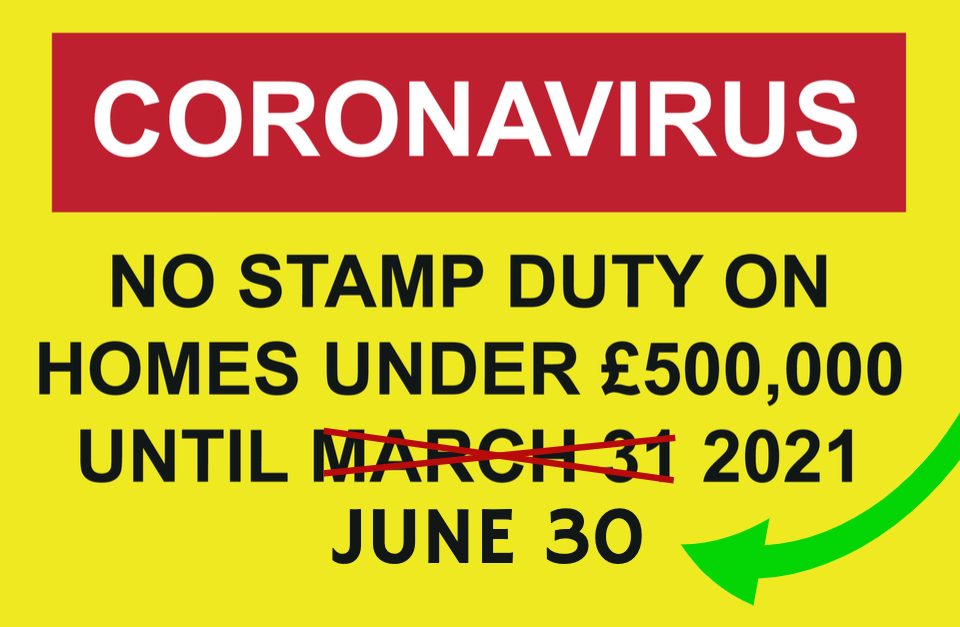

What Is The Stamp Duty Holiday?

March 12, 2021Stamp duty (SDLT) is a tax people pay when buying land or property in the UK above a certain value. SDLT has been subject to numerous changes over the years meaning people don’t always know where they stand or what they owe, meaning many people are eligible to reclaim overpaid stamp duty. The SDLT legislation contains numerous exemptions, reliefs and qualifying criteria and little guidance is provided for specific cases meaning the information is generic at best, even on the government website. Many people do not know where to go to reclaim overpaid stamp duty or where to find the best and most accurate SDLT reclaim service. This is where we can help. In fact, we have made claiming back stamp duty as easy as it can be.

SDLT RATES

In times when the STLT holiday is not in effect and normal SDLT rates are applied, then properties and land in England and Northern Ireland have a threshold of £125,000 for residential properties and £150,000 for non-residential above which Stamp Duty will be charged. There are different rates of stamp duty and what you pay depends on the property price and the band that each portion falls within.

For example, if you had bought a £400,000 house in England as your main (and only) home and you were not a first-time buyer, the stamp would be calculated like this:

- 0% on the first £125,000 = £0

- 2% on the next £125,000 = £2,500

- 5% on the final £150,000 = £7,500

Total stamp duty land tax (SDLT) = £10,000

However, in April 2016, rates were increased for second homes and buy-to-let properties. This means an extra 3% surcharge is payable on top of the existing SDLT rates.

If the above example was a second home the following calculation would apply:

- 3% on the first £125,000 = £3,750

- 5% on the next £125,000 = £6,250

- 8% on the final £150,000 = £12,000

Total SDLT = £22,000.

The important bit comes now: circumstances are not always that straightforward so buyers can claim a stamp duty refund if they sell their main residence within three years of completion on a new home.

This three-year rule has been extended due to coronavirus, for anyone who purchased a new main residence on or after January 1, 2017. These people may be eligible to apply for a refund if they were unable to sell their previous main residence before the expiry of the three-year time limit owing to exceptional circumstances beyond their control. These exceptional circumstances include being prevented from selling the property owing to government guidance during the Covid-19 pandemic.

In the above case the refund would be the 3% surcharge; the amount above what you would have been charged had the property not been a main residence. In this case, the refund is £12,000. There is no getting around having to pay the extra in the first place, but it’s a comfort to think you may get it back.

Overpayments

It’s not just people with second homes who are eligible to reclaim overpaid stamp duty. Some transactions which have potential for incorrect calculations are those for:

- Land over half a hectare (1.24 acres) and/or agricultural land with paddocks, stables etc.

- Commercial or non-residential buildings on the land.

- Offices bought using ‘permitted developments rights’.

- Land with planning permission for residential development and construction.

- Annexes, flats, cottages, granny flats in the grounds

How do I claim Back Stamp Duty?

It is not necessary to use a solicitor or accountant when claiming back stamp duty. You can apply using our online form. The information it would be useful to have to hand is:

- Your name and address

- Details of the property that attracted the higher rates of SDLT, including the date of purchase and the SDLT unique transaction reference number

- Details of the home you’ve sold, including the date of sale, the address of the property and the name of the buyer

- The amount of tax paid on the property that attracted the higher rates of SDLT

- The amount of tax you’re asking for a repayment of

It’s always best to begin your claim sooner rather than later as there are deadlines to think about. It is important that the claim deadlines are not missed. Under normal circumstances (when coronavirus extensions do not apply), Stamp Duty claims can only be submitted within four years of the property purchase. We can help with your Stamp Duty refund application and ensure that the right paperwork is submitted.

Talk To Our Experts

We provide a no win, no fee, Stamp Duty reclaim service. We fully review your property purchase to ensure that you have paid the correct amount of stamp duty. Assuming you proceed, we will prepare a formal repayment claim and administer it on your behalf.

A fee is only payable when you receive your refund from HMRC. This will be a pre-agreed percentage of your refund.

Remember: there is normally a 4 year time limit from the date of the purchase of the property to reclaim overpaid stamp duty, so please contact us ASAP to find out if you are eligible.

Reclaim Overpaid Stamp Duty: Checklist

- Get together all relevant information

- Check that you qualify for a rebate

- Use a tax calculator to work out how much you are owed

- Let us do the rest.

Claiming back stamp duty couldn’t be easier: to use our SDLT Reclaim Service, simply get in touch with some very brief details of the property you have bought, the purchase price and the amount of SDLT you paid. Or make an appointment here and one of our specialists will call you back.